Is Etsy a Hidden Gem? Stock Analysis and Valuation Inside

Table of Contents:

- Introduction

- Description of Etsy

- Revenue Sources of Etsy

- Financial Performance of Etsy

- Intrinsic Valuation of Etsy

- Operating Profit Margin of Etsy

- Geographic Distribution of Etsy's Revenue

- Growth Strategy of Etsy

- Balance Sheet Analysis of Etsy

- Revenue Forecast of Etsy

- Intrinsic Valuation of Etsy

- Conclusion

Introduction

Etsy is a unique and creative goods marketplace that has garnered attention due to its interesting stock price movement over the past year. In this article, we will dive into the company's background, how it generates revenue, its financial performance, and conduct an intrinsic valuation to assess its worth.

Description of Etsy

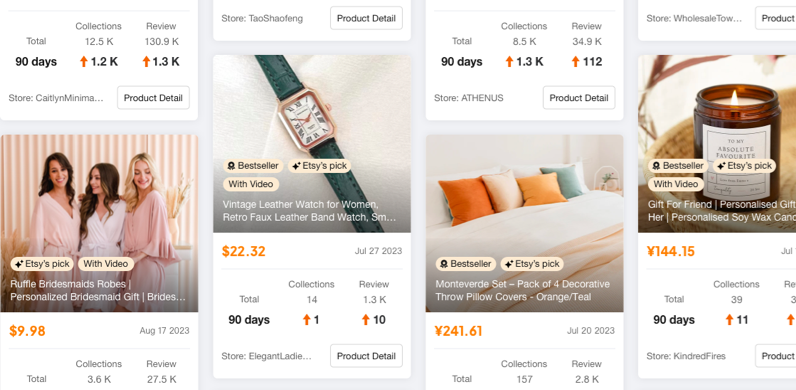

Etsy is a popular online marketplace where individuals can buy and sell unique and handmade goods. It provides a platform for artists, craftsmen, and sellers to showcase and sell their creations to a global audience. With its user-friendly interface and wide array of products, Etsy has become a go-to destination for those seeking one-of-a-kind items.

Revenue Sources of Etsy

Etsy generates revenue from two main sources: required fees and service revenues. The required fees include listing fees, transaction fees, payment platform fees, and offsite ads fees. These fees have become the dominant source of revenue for Etsy in recent years. On the other hand, service revenues are optional and include fees for additional services provided to sellers. While not as substantial as the required fees, service revenues still contribute a significant portion to Etsy’s total revenue.

Financial Performance of Etsy

Over the past few years, Etsy has experienced steady revenue growth, with an average annual growth rate of around 30%. This growth was further accelerated in 2020 due to the COVID-19 pandemic, as more people turned to Etsy for alternative sources of income. However, it is important to note that the exceptional growth rate of 111% in 2020 is unlikely to be sustained in the future. Nonetheless, Etsy's ability to attract international buyers indicates that there is still ample room for growth outside of the US market.

Intrinsic Valuation of Etsy

To estimate the intrinsic value of Etsy, we consider factors such as revenue growth, operating margin, tax rate, sales to capital ratio, and the cost of capital. By forecasting future revenue growth and subtracting necessary expenses, we can arrive at the free cash flow to the firm. Discounting this cash flow and adding the value of non-operating assets and equity options, we can determine the value of equity per share. Comparing this value to the current stock price can provide insights into the potential overvaluation or undervaluation of Etsy.

Operating Profit Margin of Etsy

Etsy's operating profit margin has shown a significant increase over the past few years, reaching 25% in 2020. This can be attributed to their efficient revenue generation model, where they act as intermediaries between buyers and sellers. Compared to competitors who purchase and resell goods, Etsy's operating margin appears higher due to their revenue being a percentage of the total value of goods sold on the platform. This margin is considered reasonable for a company operating in the online marketplace industry.

Geographic Distribution of Etsy's Revenue

Etsy generates a substantial portion of its revenue from the United States, with around two-thirds coming from this market. The United Kingdom accounts for approximately 11% of their total revenue, while the rest of the international market represents the remaining portion. This distribution highlights the potential for growth outside of the US market and Etsy's ability to attract buyers from around the world.

Growth Strategy of Etsy

Etsy's growth strategy focuses on two key aspects: increasing marketing expenditure to attract more buyers and sellers to the platform and exploring opportunities for strategic acquisitions. By investing in marketing efforts, Etsy can expand its user base and increase transaction volume, thereby driving revenue growth. Additionally, strategic acquisitions, such as the acquisition of Reverb, a marketplace for musical instruments, demonstrate Etsy's commitment to expanding its presence in related domains.

Balance Sheet Analysis of Etsy

Etsy's balance sheet showcases a healthy financial position, with a significant portion of their assets being liquid in nature. Cash and short-term investments make up approximately 80% of their total current assets, providing them with a robust liquidity position. The non-current assets primarily consist of property, plant, and equipment, along with an increase in goodwill and other intangibles due to acquisitions like Reverb. This highlights Etsy's willingness to grow through strategic acquisitions.

Revenue Forecast of Etsy

Based on historical revenue growth and industry trends, it is reasonable to assume a consistent growth rate for Etsy. A growth rate of 30% for the next few years seems feasible, considering the company's past performance. As Etsy continues to attract more buyers and sellers and explores international markets, a growth rate of 20% for the subsequent five years is a prudent estimate. This would position Etsy as a mature company without overstating its long-term growth potential.

Intrinsic Valuation of Etsy

By forecasting future revenue, considering operating margin, tax rate, sales to capital ratio, and the cost of capital, we can determine the intrinsic value of Etsy. The valuation takes into account the free cash flow generated by the company over a ten-year period, the terminal value, and the value of equity. By subtracting equity options and dividing the value by the number of shares, we arrive at the intrinsic value per share. Comparing this value to the current stock price allows us to assess the potential overvaluation or undervaluation of Etsy.

Conclusion

In conclusion, Etsy is a unique and creative goods marketplace that has experienced impressive growth in recent years. Its revenue generation model, strong balance sheet, and strategic growth initiatives position it for continued success. Conducting an intrinsic valuation can aid in assessing the potential value of Etsy's shares. However, it is important to conduct thorough research and analysis, incorporating personal assumptions and market trends, while making investment decisions.

WHY YOU SHOULD CHOOSE Etsyshop

WHY YOU SHOULD CHOOSE Etsyshop